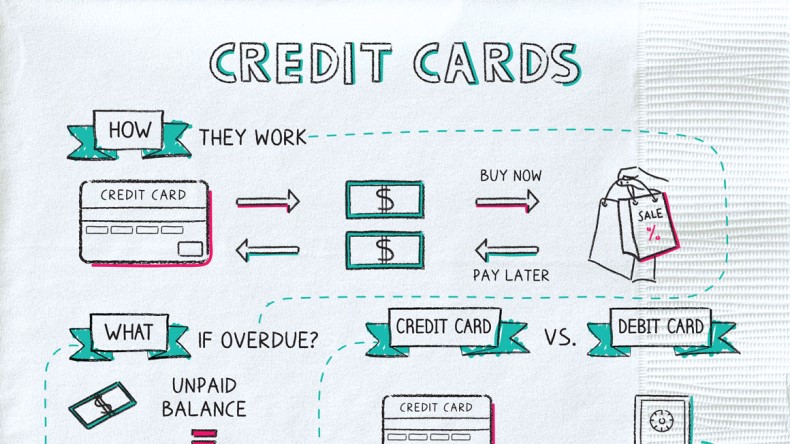

The grace period is void when you don’t pay. A credit card allows you to pay for things with borrowed money.

Charge It Right Fdic Money Smart For Young Adults - Ppt Download

You got a credit card at a great interest.

5 facts about credit cards. When you use a credit card, you are using “borrowed” money to make a purchase or obtain a cash advance, and you must pay it. Other studies show that most americans carry an average balance of. The smart way to use cards is to pay the balance in full each month.

While accepting credit cards comes with a cost, you may be losing even more money by not accepting electronic. Interest you're borrowing money when you use a credit card. Here are five interesting or little known facts about credit cards you can bring up the next time there’s a lull in the conversation (a few of them might even save you some money, too):

Credit has been around since 1750 b.c. Chase also ranked highest in the us for purchase volume for. 5 fun facts about credit cards.

Five of the eight biggest card companies in the world are. Credit card issuers can increase interest rates as much as they choose. Understanding your card’s interest rates.

Credit cards symbolize different things to different people. 12 surprising credit card facts & statistics 1. It became visa in 1976.

Here are 5 unknown facts about credit cards: There are so many credit cards in circulation that they could span a total of 86,981 miles if set side by side. This might come as scary news to you as it did to me.

Here are 10 things you should know about credit cards. Visa had 800 million in circulation in 2013. The cost of accepting credit cards is too high.

Most studies show that over 70% of americans own at least one credit card and carry it with them when they go shopping. Chase has the world’s largest credit card portfolio. Chase led us purchase volume in 2021.

Credit cards are useful tools for building credit, and you don’t need to carry a minimum balance to build good credit. The system of an object used to identify a customer is only about 100 years old. 0% balance transfer cards are a great way of avoiding interest charges when looking to.

If you don’t pay off your debt in full, you’ll notice the interest charges start to pile up quickly. The dangers of missing payments on 0% interest cards. The top five most common credit card uses are:

10 Credit Card Facts That Will Blow Your Mind

:max_bytes(150000):strip_icc()/difference-between-a-credit-card-and-a-debit-card-2385972-Final-5c4731cbc9e77c00018a49e9-56c75e11badb4a268ed1660a515c136d.jpg)

The Difference Between A Credit Card And A Debit Card

10 Surprising Credit Card Debt Facts | Sofi