What tax forms do freelancers need to complete? Enter your actual expenses—for gas, oil changes, repairs, insurance, etc.—if you have supporting documentation, or take the irs standard mileage rate.

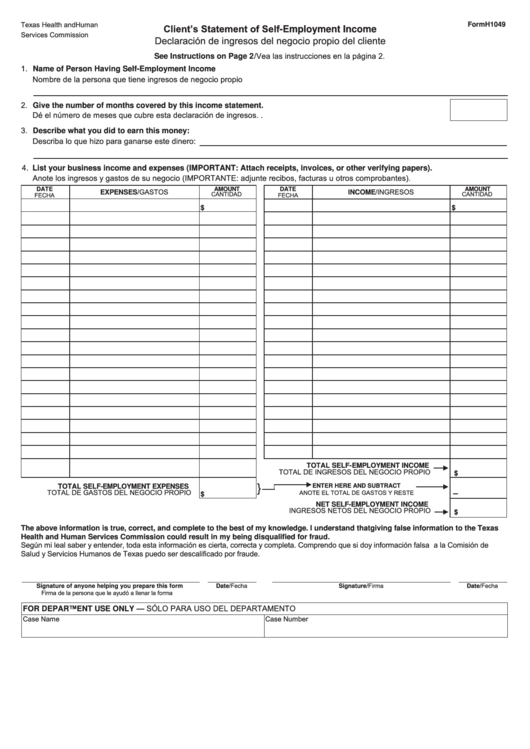

Form H1049 Client'S Statement Of SelfEmployment printable pdf

I can confirm that sole proprietors must report their income and expenses on form t2125.

Where to enter self employment income. The canada revenue agency (cra) says that business income is income from any activity you carry out for profit or with a. Alberta, for example, has no provincial sales taxes so a $1.00 bag of pretzels will cost you $1.05 at the checkout. Business income includes income from any activity you carry out for profit or with reasonable.

Watch the video for find where they must be entered on your tax return. All of this is done on schedule c. There is also provincial/territory tax based on the location of the business as.

The rate for 2021 is 56 cents per mile. Enter the identifying information for your business (if relevant) in this tab. Paying your ei premiums if you’re a shareholder of.

A gst/hst provincial rates table as well as a calculator, can be found here. You must meet all the above conditions to keep the cerb. What kind of income did you earn?

It could include income from a business, profession, commission sales, farming, or fishing activities. Otherwise, leave this field blank. On the prepare tab, click the let’s talk about 2016 icon.

Visit our tax & u page for more ta. If you've already worked in this section, select editnext to your business, then add expenses for this work select start next to an expense type that you had enter your expense description and amount, and answer any other questions we ask if you had more than one expense for a type, select add another groupto include them all If she also pays income taxes to the foreign company then you can use the foreign tax credit form 1116 so she is not double taxed however she cannot avoid.

If you are starting a small business, see the checklist for small businesses. Register online for the program pay ei premiums you can apply for special benefits 12 months after your confirmed registration date. If she is a sole prop then the sch c is the correct place to enter the income.

Forms to use most people will use the schedule c form. In ontario, for example, where there is hst, that $1.00 bag of pretzels would cost $1.13, as the hst in ontario is currently 13%. This income is subject to federal tax, calculated on schedule 1.

Enter your cra business number, if you have one. The checklist provides important tax information. Continue through the interview to enter your business information.

Go to federal > income & expenses scroll down to see all income. If you haven’t registered a business name, leave this field blank. You can report these costs in one of two ways:

Lines 13499 to 14299 were lines 162 to 170 and lines 13500 to 14300 were lines 135 to 143 before tax year 2019. Regular workers contribute a particular percentage of their wages above $3,500, up to an annual maximum, while their employer contributes an equal amount.

Self Employment Statement Template Best Of Profit and Loss

Self Employment Ledger Template Amazing Self Employment Ledger Template

Self Employment Statement Template Best Of Balance Sheet

Self Employment Statement Template Beautiful Self Employed

Self Employment Statement Template New Self Employment Ledger 40